Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof23. Credit risk: monthly returnDirectives and interpretations for completion of monthly return concerning credit risk (Form BA 200)Subregulation (11) Method 1 : Calculation of credit risk exposure in terms of the foundation IRB approachSubregulation (11)(d) Risk-weighted exposure |

| (d) | Risk-weighted exposure |

| (i) | Unless specifically otherwise provided in this paragraph (d), in order to calculate its risk-weighted credit exposure, a bank that adopted the foundation IRB approach for the measurement of the bank's exposure to credit risk in respect of positions held in the bank's banking book— |

| (A) | shall in the case of exposures other than retail exposures and purchased retail receivables calculate its own estimate of probability of default ("PD") in respect of each relevant borrower grade or credit exposure; |

| (B) | shall in the case of retail exposures and purchased retail receivables calculate its own estimate of PD in respect of each relevant pool of retail exposures; |

| (C) | shall in the case of exposures other than retail exposures and purchased retail receivables apply standardised estimates in respect of loss-given-default ( "LGD"), exposure-at-default ("EAD") and maturity ("M"), which standardised estimates— |

| (i) | are specified below in respect of each relevant asset class; or |

| (ii) | shall be determined by the Registrar; |

| (D) | shall in the case of retail exposures and purchased retail receivables calculate its own estimates of LGD and EAD; |

| (E) | shall apply the risk-weight functions and risk components in respect of the various exposure categories envisaged in paragraph (c) above in ccordance with the relevant requirements specified in this paragraph (d); |

| (F) | shall in the case of securitisation exposures apply the risk-weight functions and risk components in respect of the various types of securitisation exposure in accordance with the relevant requirements specified in paragraphs (e) to (p) below. |

| (ii) | Corporate, sovereign and bank exposures |

A bank that adopted the foundation IRB approach for the measurement of the bank's exposure to credit risk shall calculate its risk-weighted assets in respect of corporate, sovereign or bank exposures through the application of the formula and risk components specified below:

| (A) | In the case of an exposure other than an exposure to a small or medium sized entity (“SME”), which exposure is not in default, as follows: |

RWA = K x 12,5 x EAD

where:

| RWA | is the risk weighted asset amount. |

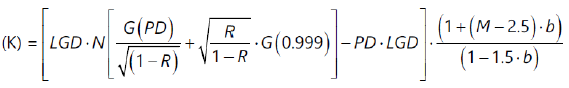

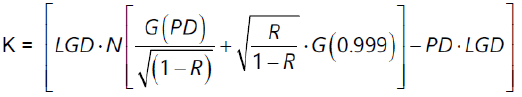

| K | is the capital requirement, which capital requirement shall be calculated through the application of the formula specified below |

Provided that when the calculation of K results in a negative capital requirement in respect of a particular exposure, the bank shall apply a capital requirement equal to zero in respect of the relevant exposure

| PD | is the probability of default, and constitutes a ratio |

In the case of exposures to—

| (i) | corporate institutions or banks, the PD ratio shall be the one-year PD associated with the relevant internal grade to which the exposure is assigned, subject to a floor of 0.05 per cent, provided that the aforementioned floor of 0.05 per cent shall not apply when the exposure to the relevant corporate or bank is guaranteed by a sovereign and the guarantee complies with the respective requirements specified in subregulation (12); |

| (ii) | sovereigns, the PD ratio shall be the one-year PD ratio associated with the relevant internal grade to which the exposure is assigned; |

| (iii) | intragroup banks or other formally regulated intragroup financial entities with capital requirements similar or equivalent to these Regulations, which banks or entities are included in the consolidated amounts calculated in accordance with the relevant requirements specified in these Regulations in respect of consolidated supervision, the PD ratio shall be deemed to be equal to zero. |

| LGD | is the loss-given-default ratio |

In the case of—

| (i) | senior claims on sovereigns, banks, securities firms and other financial institutions, including insurance companies and any financial institution that falls within the corporate asset class, not secured by eligible collateral, the bank shall apply an LGD ratio of 45 per cent; |

| (ii) | senior claims on corporates other than the persons, institutions or entities specified immediately hereinbefore in item (i), not secured by eligible collateral, the bank shall apply an LGD ratio of 40 per cent; |

| (iii) | subordinated claims, that is, a facility that is economically or otherwise expressly subordinated to another facility, in relation to any of the persons, institutions or entities specified immediately hereinbefore in items (i) and (ii), the bank shall apply an LGD ratio of 75 per cent. |

| M | is the effective maturity of the relevant exposure, which maturity shall be equal to 2.5 years, unless the exposure relates to a repurchase or resale transaction in which case an effective maturity equal to six months, that is, M = 0.5, shall apply, provided that— |

| (i) | the Authority may require; or |

| (ii) | on prior written application by the reporting bank and subject to such conditions as may be specified in writing, the Authority may allow, |

a bank to calculate the effective maturity of a particular exposure in accordance with the relevant requirements specified in subregulation (13)(d)(ii)(B) below

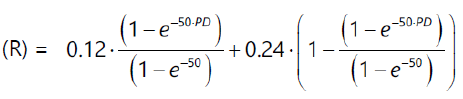

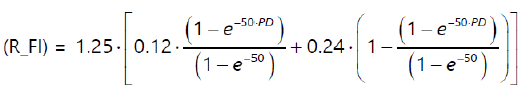

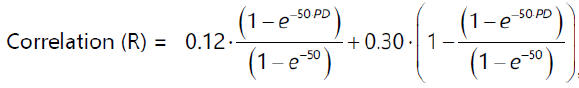

| R | is the relevant correlation, which correlation shall be calculated through the application of the formula specified below |

Provided that, in relation to all relevant exposures to financial institutions that meet the criteria specified below, the bank shall apply a multiplication factor of 1.25 to the aforesaid correlation parameter “R”, such that correlation R FI = 1.25 x R, that is

in relation to:

| (i) | any regulated financial institution with total assets greater than or equal to such amount as may be directed in writing by the Authority, |

| (aa) | which asset amount shall be based on the most recent consolidated audited financial statements of the relevant parent company and its relevant subsidiaries; |

| (bb) | which regulated financial institutions shall for purposes of these Regulations include any parent institution and its subsidiaries, where any relevant substantial legal entity in the consolidated group is supervised by a regulator that imposes prudential requirements consistent with such international norms as may be specified in writing by the Authority, which institutions shall include, but are not limited to, prudentially regulated insurance companies, broker/dealers and banks; |

| (ii) | any unregulated financial institution, regardless of size, shall for purposes of these Regulations include legal entities of which the main business includes— |

| (aa) | the management of financial assets; |

| (bb) | lending; |

| (cc) | factoring; |

| (dd) | leasing; |

| (ee) | provision of credit enhancements; |

| (ff) | securitisation or resecuritisation; |

| (gg) | investments; |

| (hh) | financial custody; |

| (ii) | central counterparty services; |

| (jj) | proprietary trading; or |

| (kk) | such other financial services activities as may be specified or directed in writing by the Authority |

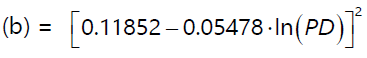

| b | is the relevant maturity adjustment, which shall be calculated through the application of the formula specified below |

| In | denotes the natural logarithm |

| EXP | is the inverse of the natural logarithm, In |

| N(x) | denotes the cumulative distribution function for a standard normal random variable, that is, the probability that a normal random variable with a mean equal to zero and variance of one is less than or equal to x. |

| G(z) | denotes the inverse cumulative distribution function for a standard normal random variable, that is, the value of x such that N(x) = z. |

| EAD | is the exposure at default, which exposure shall be measured gross of any specific credit impairment raised or partial write-offs made by the reporting bank. |

A bank shall measure its exposure at default in accordance with the relevant requirements specified below:

| (i) | In the case of any drawn amounts, the exposure at default shall be equal to the sum of the drawn amounts after the effect of set-off in accordance with the relevant requirements specified in regulation 13 has been recognised, provided that the said exposure shall not be less than the sum of— |

| (aa) | the amount by which the bank’s capital requirement would be reduced when the exposure amounts are written off in full; and |

| (bb) | any specific credit impairment raised or partial write-off made by the reporting bank in respect of the relevant exposure amounts. |

| (ii) | In the case of off-balance-sheet items other than unsettled derivative contracts, the exposure at default shall be equal to the sum of committed but undrawn amounts multiplied by the relevant credit conversion factors specified in subregulation (6)(g), provided that— |

| (aa) | when a constraining condition applies to an unused committed facility, such as a limit on the amount available for withdrawal, which limit, for example, may relate to the financial position of the relevant obligor at any time, the bank shall apply the relevant specified credit-conversion factor to the lower amount of the unused committed facility and the said constraining limit. Provided that, in such cases, the bank shall demonstrate to the satisfaction of the Authority that it has in place sufficiently robust line monitoring and management procedures to enforce the said constraining limit at all times; |

| (bb) | in the case of any uncommitted or revocable facility, the bank shall demonstrate to the satisfaction of the Authority that the bank actively monitors the financial condition of the relevant obligor and that the internal control systems of the bank are adequate to cancel a facility upon receiving evidence of a deterioration in the credit quality of the relevant obligor; |

| (cc) | when a commitment is obtained in respect of another off-balance-sheet exposure, the bank shall apply to the relevant exposure the lower of the relevant credit-conversion factors; |

| (dd) | when the bank has securitised only the drawn balances of revolving facilities, the bank shall continue to maintain the relevant required amount of capital and reserve funds against any relevant undrawn balances associated with the said securitised exposures. |

| (iii) | In the case of unsettled derivative contracts, the exposure amount or exposure at default shall be equal to the sum of amounts calculated in accordance with the relevant requirements specified in subregulations (15) to (19) below. |

[Regulation 23(11)(d)(ii)(A) substituted by section 2(aaaaa) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (B) | In the case of an exposure that is in default— |

| (i) | the capital requirement (K) shall be equal to the higher of zero and the difference between the exposure’s LGD and the bank’s best estimate of expected loss. |

The risk-weighted amount in respect of the defaulted exposure shall be calculated through the application of the formula specified below.

RWA = K x12,5 x EAD

[Regulation 23(11)(d)(ii)(B)(i) substituted by section 2(bbbbb) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (ii) | a bank shall assign to the relevant exposure a PD ratio equal to 100 per cent. |

| (C) | In the case of an exposure to an SME borrower, which SME borrower would otherwise be categorised as a corporate exposure, the bank shall make an adjustment to the formula specified in item (A) above, which adjustment shall be calculated through the application of the relevant formula, and in accordance with such conditions, as may be specified in writing by the Authority when the reported turnover or sales for the consolidated group of which the SME borrower is a member is less than such amount as may be directed in writing by the Authority. Provided that, subject to such conditions as may be specified in writing, the Authority may require banks in writing to substitute turnover or sales for assets as the base. |

[Regulation 23(11)(d)(ii)(C) substituted by section 2(ccccc) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

0.04 x (1 - (S - 40)/360)

where:

| S | shall be the total annual sales expressed in millions of Rand and the values of S falling in the range of R40 million ≤ S ≤ R400 million. |

For the purposes of the aforesaid adjustment, sales of less than R40 million shall be deemed to be equal to R 40 million

| R | is the relevant correlation, which correlation shall be calculated through the application of the formula specified below |

R = 0.12 x (1 - EXP(-50 x PD)) / (1 - EXP(-50)) + 0.24 x [1 - (1 - EXP(-50 x PD))/(1 - EXP(-50))] - 0.04 x (1 - (S- 40)/360)

| EXP | is the inverse of the natural logarithm, In |

| (iii) | Specialised lending |

| (A) | Subject to the provisions of items (B) and (C) below, a bank that adopted the foundation IRB approach for the measurement of the bank's exposure to credit risk shall calculate its risk-weighted exposure in respect of specialised lending in accordance with the relevant requirements relating to corporate exposure specified in subparagraph (ii) above, provided that the bank shall comply with the relevant requirements for the estimation of PD ratios in respect of corporate exposure. |

| (B) | In the case of high-volatility commercial real estate exposure, a bank that adopted the foundation IRB approach for the measurement of the bank’s exposure to credit risk shall apply the asset correlation formula specified below, instead of the asset correlation formula that would otherwise apply to corporate exposures. |

[Regulation 23(11)(d)(iii)(B) substituted by section 2(ddddd) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (C) | When a bank that adopted the foundation IRB approach for the measurement of the bank’s exposure to credit risk is unable to comply with the specified requirements to estimate the probability of default in terms of the foundation IRB approach for corporate exposure or the Authority directs the bank to map its internal risk grades to the risk grades specified below, the bank shall map its internal risk grades, which shall be based on the bank’s own criteria, systems and processes, to the risk grades specified below, which specified risk grades shall be linked to the risk weights for unexpected loss, and are likely to correspond to the range of external credit assessments, specified below: |

[Regulation 23(11)(d)(iii)(C) substituted by section 2(eeeee) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (iv) | Retail exposures |

A bank that adopted the foundation IRB approach for the measurement of the bank's exposure to credit risk shall calculate its risk-weighted assets in respect of retail exposures through the application of the relevant formulae and risk components specified below:

| (A) | In the case of residential mortgage exposures not in default, as follows: |

RWA = K x 12,5 x EAD

where:

| RWA | is the relevant risk-weighted asset amount |

| K | is the capital requirement, which capital requirement shall be calculated through the application of the formula specified below: |

| PD | is the probability of default, and constitutes a ratio |

A bank shall apply a PD ratio equal to the higher of the one-year PD associated with the relevant internal grade to which the pool of exposures is assigned, or 0.05 per cent.

| LGD | is the loss-given-default ratio estimated by the bank, provided that— |

| (i) | the LGD estimate in respect of retail exposures secured by residential property shall in no case be less than 5 per cent unless the said exposure is protected by a guarantee obtained from a sovereign; |

| (ii) | the Authority may amend the minimum LGD ratio of 5 per cent subject to such conditions as may be specified in writing by the Authority. |

| R | is the correlation, which correlation shall be a constant number equal to 0.15 |

| EAD | is the exposure at default, which shall be measured gross of any specific credit impairment raised or partial write-offs made by the reporting bank, as follows: |

| (i) | In the case of any drawn amounts, the exposure at default shall be equal to the sum of the drawn amounts after the effect of set-off in accordance with the relevant requirements specified in regulation 13 has been recognised, provided that the said exposure shall not be less than the sum of— |

| (aa) | the amount by which the bank’s capital requirement would be reduced when the exposure amounts are written off in full; and |

| (bb) | any specific credit impairment raised or partial write-off made by the reporting bank in respect of the exposure amounts. |

| (ii) | In the case of any undrawn revolving commitment to extend credit, purchase assets or issue credit substitutes, the bank shall use its own estimates of EAD, provided that— |

| (aa) | the bank shall comply with the relevant requirements specified in subregulation (13)(b)(v)(D); |

| (bb) | when the relevant off-balance-sheet exposure is subject to a CCF of 100 per cent in terms of the provisions of subregulation (6)(g) read with subregulation (8)(g), the bank shall apply to the said exposure a CCF equal to 100 per cent; |

| (cc) | in the case of any undrawn non-revolving commitment the bank shall apply to the relevant off-balance-sheet exposure the relevant CCF specified in subregulation (6)(g); |

| (dd) | when the bank does not comply with the relevant requirements specified in subregulation (13)(b)(v)(D), the bank shall apply to the relevant off-balance-sheet exposure the relevant CCF specified in subregulation (6)(g); |

| (ee) | when the bank’s relevant retail off-balance-sheet exposures are subject to uncertain future drawdown, such as in the case of credit card exposures, the bank shall take into account its history and/or expectation of additional drawings prior to default; |

| (ff) | when the bank’s estimate of EAD does not adequately incorporate additional drawings on undrawn lines prior to default, as envisaged hereinbefore, the bank shall make appropriate adjustments to its estimates of LGD; |

| (iii) | When the bank has securitised only the drawn balances of revolving retail facilities, the bank shall continue to maintain the required amount of capital and reserve funds against the undrawn balances associated with the said securitised exposures, in accordance with the requirements specified hereinbefore for the related commitments. |

| (iv) | To the extent that the bank is exposed to foreign exchange and interest rate commitments within the bank’s retail portfolio, the bank shall not apply any internal estimate of a credit equivalent amount or EAD amount, and the bank shall include the said commitments in accordance with the relevant requirements specified in subregulation (6)(g). |

[Regulation 23(11)(d)(iv)(A) substituted by section 2(fffff) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (B) | In the case of qualifying revolving retail exposures not in default, as follows: |

RWA = K x 12,5 x EAD

where:

| RWA | is the relevant risk-weighted asset amount |

| K | is the capital requirement, which capital requirement shall be calculated through the application of the formula specified below |

| PD | is the probability of default, and constitutes a ratio |

A bank shall apply a PD ratio equal to the higher of the one-year PD ratio associated with the relevant internal grade to which the pool of exposures is assigned, or 0.1 per cent.

| LGD | is the loss-given-default ratio as estimated by the bank, provided that the LGD ratio shall in no case be lower than 50 per cent |

| R | is the correlation, which correlation shall be a constant number equal to 0.04 |

| EAD | is the exposure at default, which exposure shall be measured in accordance with the relevant requirements relating to the measurement of EAD specified in item (A) above. |

[Regulation 23(11)(d)(iv)(B) substituted by section 2(ggggg) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (C) | In the case of other retail exposures, which other retail exposures are not in default, as follows: |

RWA = K x 12,5 x EAD

where:

| RWA | is the relevant risk-weighted asset amount |

| K | is the capital requirement, which capital requirement shall be calculated through the application of the formula specified below |

| PD | is the probability of default, and constitutes a ratio |

A bank shall apply a PD ratio equal to the higher of the one-year PD ratio associated with the relevant internal grade to which the pool of exposures is assigned, or 0.05 per cent.

| LGD | is the loss-given-default ratio as estimated by the bank, provided that the LGD ratio shall in no case be lower than the respective percentages specified hereinbefore, in paragraph (b)(vi)(B)(x)(dd) |

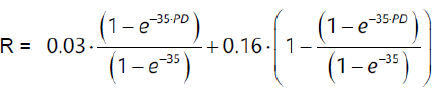

| R | is the correlation, calculated through the application of the formula specified below, which allows the correlation to vary with the PD of the exposure |

| EXP | is the inverse of the natural logarithm, ln |

| EAD | is the exposure at default, which exposure shall be measured in accordance with the relevant directives relating to the measurement of EAD specified in item (A) above. |

[Regulation 23(11)(d)(iv)(C) substituted by section 2(hhhhh) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (D) | In the case of retail exposures in default— |

| (i) | the capital requirement (K) shall be equal to the higher amount of zero and the difference between the exposure’s LGD and the bank’s best estimate of expected loss, provided that— |

| (aa) | the LGD estimate in respect of retail exposures secured by residential property shall in no case be less than 5 per cent unless the said exposure is protected by a guarantee obtained from a sovereign; |

| (bb) | the Authority may amend the said minimum LGD ratio of 5 per cent subject to such conditions as may be specified in writing by the Authority; |

| (ii) | the bank shall assign to the relevant exposure a PD ratio equal to 100 per cent; |

| (iii) | the exposure at default shall be measured in accordance with the relevant directives relating to the measurement of EAD specified in item (A) above; |

| (iv) | the relevant risk-weighted exposure amount shall be calculated through the application of the formula specified below: |

RWA =K x12,5 x EAD

[Regulation 23(11)(d)(iv)(D) substituted by section 2(iiiii) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (v) | Equity exposures |

A bank shall calculate its relevant required amount of risk-weighted exposure related to its equity exposures held in the bank’s banking book in accordance with the relevant requirements specified in this subregulation (11) read with the relevant requirements specified in subregulation (8)(j), subregulation (6)(j), regulation 31 and regulation 38. Provided that during the relevant phase-in period specified in subregulation (6)(j), the bank’s risk-weighted exposure amount related to its equity exposures shall be the higher of the risk-weighted exposure amount calculated in terms of—

| (A) | the IRB approach specified in this subregulation (11) read with regulation 31 and regulation 38; and |

| (B) | the linear phase-in arrangement specified in subregulation (6)(j) read with subregulation (8)(j). |

[Regulation 23(11)(d)(v) substituted by section 2(jjjjj) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (vi) | Purchased receivables |

| (A) | A bank shall separately calculate its risk-weighted assets in respect of purchased retail receivables and purchased corporate receivables, provided that the bank shall in the calculation of its risk-weighted exposure in respect of a particular purchased receivable or pool of purchased receivables distinguish between— |

| (i) | the risk of default |

When purchased receivables unambiguously belong to one asset class, the bank shall calculate the risk of default relating to the said receivables in accordance with the riskweight function and risk components applicable to that particular exposure type, provided that the bank shall comply with the relevant requirements in respect of the relevant risk-weight function. For example, when the receivables consist of—

| (aa) | revolving retail exposures but the bank is unable to comply with the requirements relating to qualifying revolving retail exposures, the bank shall apply the risk-weight function relating to other retail exposures; |

| (bb) | hybrid pools containing a mixture of exposure types, that is, the bank is unable to separate the exposures by type, the bank shall apply the risk-weight function producing the highest capital requirement for the exposures included in the pool of purchased receivables. |

| (ii) | the risk of dilution |

In the case of purchased corporate receivables and purchased retail receivables, a bank shall calculate the risk weights relating to the risk of dilution, that is, the risk that a receivable amount may be reduced by way of cash or noncash credit amounts being made against the receivable account, for example, as a result of the return of goods that were sold or disputes regarding the quality of a product, in accordance with the corporate risk-weight function specified in subparagraph (ii) above, provided that—

| (aa) | the bank shall estimate the one-year expected loss ratio for dilution risk, expressed as a percentage of the receivable amount, in respect of the pool as a whole or the individual receivables included in the pool on a stand-alone basis, that is, without regard to any assumption of recourse, support or guarantees from the seller or other parties; |

| (bb) | the bank may use relevant external or internal data to estimate the said expected loss ratio; |

| (cc) | the bank shall set the PD estimate equal to the estimated expected loss ratio and the LGD ratio equal to 100 per cent; |

| (dd) | the bank shall apply such a maturity factor as may be specified in writing by the Registrar or, with the prior written approval of the Registrar and provided that the bank manages the risk of dilution in an appropriate manner, a one-year maturity factor; |

| (ee) | when the risk of dilution is immaterial for the purchasing bank, the bank may apply for the approval of the Registrar not to calculate risk weights in respect of the risk of dilution. |

| (B) | Purchased retail receivables |

A bank shall calculate the risk estimates of PD and LGD, or expected loss, in respect of default risk relating to purchased retail receivables on a stand-alone basis, that is, without regard to any assumption of recourse or guarantees from the seller or other parties, provided that—

| (i) | the bank shall comply with the relevant minimum requirements relating to retail exposures specified in paragraphs (b)(v)(D), (b)(vi)(B), (b)(viii)(D), (b)(viii)(E) and (c) (iv) above; |

| (ii) | the bank may use external and internal reference data to estimate the PD ratio and LGD ratio relating to the relevant exposure; |

| (iii) | when the bank complies with the relevant minimum requirements in respect of retail exposure as envisaged in sub-item (i) above, the bank may apply the "top-down" approach envisaged in paragraph (b)(vi)(F) above in order to calculate the said estimates of PD and LGD, provided that the bank shall in addition to the said requirements in respect of retail exposure comply with the relevant requirements relating to the "top-down" approach, specified in paragraph (b)(vi)(F) above. |

| (C) | Purchased corporate receivables |

| (i) | A bank shall calculate the risk-weighted assets relating to default risk of individual obligors in respect of purchased corporate receivables in accordance with the formula and risk components specified in subparagraph (ii) above, which formula and risk components relate to corporate exposure, provided that— |

| (aa) | when the bank is unable to decompose the expected loss ratio into its PD and LGD components, the bank— |

| (i) | shall determine the risk weight in respect of the purchased corporate receivable from the corporate risk-weight function using a LGD ratio of 40 per cent, provided that the exposures shall consist exclusively of senior claims in respect of corporate borrowers; |

[Regulation 23(11)(d)(vi)(C)(i)(aa)(i) substituted by section 2(kkkkk) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (ii) | shall calculate the related PD ratio by dividing the expected loss ratio by the said LGD ratio of 40 per cent; |

[Regulation 23(11)(d)(vi)(C)(i)(aa)(ii) substituted by section 2(lllll) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (iii) | shall calculate the EAD amount as the outstanding amount minus the capital requirement relating to the risk of dilution, before the bank takes into consideration the effect of any risk mitigation instrument, provided that in the case of a revolving facility the EAD amount shall be equal to the purchased receivable amount plus 40 per cent of any undrawn purchased commitments minus the capital requirement relating to the risk of dilution; |

[Regulation 23(11)(d)(vi)(C)(i)(aa)(iii) substituted by section 2(mmmmm) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (iv) | shall in all cases other than the exposures already specified in this sub-item (aa), use a PD ratio equal to the expected loss ratio, a LGD ratio equal to 100 per cent and an EAD amount equal to the outstanding amount minus the capital requirement relating to the risk of dilution, before the bank takes into consideration the effect of any risk mitigation instrument; |

| (bb) | when the bank is able to estimate the PD ratio in a reliable manner, the bank shall determine the risk weight in respect of the relevant exposure from the corporate risk weight function, based on the relevant requirements relating to LGD and M; |

| (ii) | Subject to the prior written approval of and such conditions as may be specified in writing by the Registrar, a bank may apply the "top-down" approach envisaged in paragraph (b)(vi)(F) above in order to calculate the risk weight relating to default risk in respect of a pool of purchased corporate receivables, provided that— |

| (aa) | the bank's programme in respect of purchased corporate receivables shall comply with the relevant requirements specified in paragraph (b)(vi)(F) above; |

| (bb) | the receivables— |

| (i) | shall be purchased from unrelated, third party sellers, that is, the receivables shall not be originated, either directly or indirectly, by the reporting bank; |

| (ii) | shall be generated on an arm's-length basis between the seller and the relevant obligor; |

| (cc) | the bank— |

| (i) | shall have a claim in respect of all proceeds from the pool of receivables or a relevant pro rata interest in the proceeds, which claim shall exclude any first-loss or second-loss positions, that is, the cash flows arising from the purchased corporate receivables shall be the reporting bank's primary protection against default risk; |

| (ii) | shall estimate the pool's one-year expected loss ratio for default risk, expressed as a percentage of the exposure amount, that is, the total EAD amount due to the bank by all obligors in the pool of purchased receivables; |

| (iii) | shall estimate the expected loss ratio in respect of the purchased receivables on a stand-alone basis, that is, without regard to any assumption of recourse or guarantees from the seller or other parties; |

| (iv) | shall, based on the pool's estimated one-year expected loss ratio for default risk, calculate the risk weight for default risk in accordance with the risk-weight function for corporate exposures specified in subparagraph (ii) above; |

| (v) | shall utilise relevant external and internal data to estimate the required PD ratios and LGD ratios; |

| (vi) | shall follow the directives specified in sub-item (i)(aa) above when the bank is unable to decompose the expected loss ratio into its PD and LGD components; |

| (dd) | the Registrar shall grant approval to apply the "topdown" approach only in exceptional cases when the calculation of the bank's risk-weighted exposure in respect of purchased corporate receivables in accordance with the requirements specified in subparagraph (ii) relating to corporate exposure is likely to place an undue burden on the reporting bank; |

| (D) | Purchase price discounts in respect of purchased receivables |

| (i) | When a bank sells receivables at a discount, which purchase price discount— |

| (aa) | effectively provides first loss protection in respect of the risk of default and/ or dilution; and |

| (bb) | may be refunded to the seller based upon the performance of the relevant receivables, |

the bank shall risk weight the relevant refundable purchase price discount related to the receivables in accordance with the relevantrequirements related to first loss protection specified insubregulation (6)(j) read with the exemption notice relating to securitisation schemes.

| (ii) | A bank that purchased receivables at a discount, as envisaged in sub-item (i) hereinbefore, may recognise the relevant purchase price discount that may be refunded to the seller based upon the performance of the relevant receivables, as first-loss protection obtained, in accordance with the relevant requirements specified in these Regulations read with the exemption notice relating to securitisation schemes. |

| (iii) | A bank shall ignore any purchase price discounts that were granted in respect of any purchased corporate or retail receivables other than the purchase price discounts envisaged in sub-items (i) and (ii) hereinbefore, when the bank calculates its risk-weighted exposure or credit impairments relating to expected loss, provided that the said discounts shall constitute non refundable amounts, that is, the said discounts shall not be repayable to the relevant seller of the receivable amounts. |

[Regulation 23(11)(d)(vi)(D) substituted by section 2(nnnnn) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (vii) | Cash and cash equivalent amounts |

A bank shall risk weight all cash and cash equivalent amounts such as gold bullion at zero per cent.

| (viii) | Securitisation or resecuritisation exposure |

A bank shall calculate its risk-weighted assets in respect of a securitisation scheme or resecuritisation exposure in accordance with the relevant requirement specified in paragraphs (e) to (p) below.

(ix) Other exposures

Unless specifically otherwise stated, a bank shall risk weight all exposures other than the exposures specified above at a risk weight of 100 per cent, which risk weight shall be deemed to represent the unexpected loss in respect of the relevant exposure.