Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof23. Credit risk: monthly returnDirectives and interpretations for completion of monthly return concerning credit risk (Form BA 200)Subregulation (12) Credit risk mitigation: foundation IRB approachSubregulation (12)(c) Pools of collateral |

(c) Pools of collateral

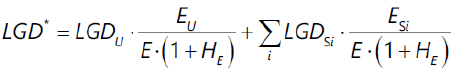

When a bank obtains both eligible financial collateral and other eligible collateral, that is, collateral regarded as eligible collateral in terms of the foundation IRB approach but not in terms of the standardised approach, in respect of the bank’s exposure to corporate institutions, sovereigns or banks, the bank shall apply the formula set out hereinbefore in paragraph (b)(iii) sequentially for each relevant individual type of eligible collateral. In other words, after each relevant step of recognising one individual type of eligible collateral, the bank shall reduce the remaining value of its unsecured exposure, denoted by EU, by the adjusted value of the relevant eligible collateral, denoted by ES, recognised in each relevant step up to that point, provided that, as stated in paragraph (b)(iii) hereinbefore, the total value of ES across all relevant eligible collateral types shall be restricted to the value of E * (1 + HE), as follows:

where, in respect of each relevant eligible collateral type i:

| LGDSi | is the relevant LGD applicable to that particular form of eligible collateral |

| ESi | is the relevant current value of the collateral received after the application of the relevant haircut specified for that specific type of eligible collateral |

[Regulation 23(12)(c) substituted by section 2(xxxxx) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]