| (d) | Risk-weighted exposure |

| (i) | Unless specifically otherwise provided in this subregulation (13), in order to calculate its risk-weighted credit exposure, a bank that adopted the advanced IRB approach— |

| (i) | eligible or permitted exposures to corporate institutions, sovereigns or banks calculate its own estimates of probability-of-default (“PD”), loss-given-default (“LGD”), exposure-at-default (“EAD”) and effective maturity (“M”) in respect of each relevant borrower grade or credit exposure, provided that— |

| (aa) | the bank shall comply with the relevant minimum requirements specified in respect of the said risk components in subregulations (11)(b) and (11)(d) above and in this subregulation (13); |

| (bb) | the EAD amount related to each relevant eligible or permitted exposure that is used as an input into any relevant risk weight formula as well as for the calculation of any relevant expected loss amount shall be subject to a floor amount equal to the sum of— |

| (i) | the relevant on-balance-sheet amount; and |

| (ii) | 50 per cent of the bank’s relevant off-balance-sheet exposure based upon the relevant CCFs specified in subregulation (6) read with subregulation (8); |

| (cc) | the bank shall not apply the advanced IRB approach in respect of: |

| (i) | any general corporate exposure to a person, entity or institution belonging to a group of persons, entities or institutions of which the total consolidated annual revenues reported in the group audited financial statements exceed such amount as may be directed in writing by the Authority and calculated in the manner directed in writing by the Authority; |

| (ii) | any exposure to a bank, as defined in subregulation (8), securities firm or financial institution, including any insurance company or any other relevant financial institution that falls within the ambit of the corporate asset class; |

[Regulation 23(13)(d)(i)(A)(i) substituted by section 2(ssssss) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (ii) | retail exposures and purchased retail receivables calculate its own estimates of PD, LGD and EAD in respect of each relevant retail pool of exposures, provided that the bank shall comply with the relevant minimum requirements specified in respect of the said risk components in subregulations (11)(b) and (11)(d) above and in this subregulation (13); |

| (iii) | equity exposures apply the relevant requirements specified in subregulations (6)(j) and (8)(j) read with the relevant requirements specified in regulations 31 and 38; |

[Regulation 23(13)(d)(i)(A)(iii) substituted by section 2(tttttt) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (B) | shall apply the risk-weight functions and risk components in respect of the various exposure categories in accordance with the relevant requirements specified in this subregulation (13) read with subregulation (11)(d) above. |

| (ii) | Corporate, sovereign and bank exposures |

A bank that adopted the advanced IRB approach for the measurement of the bank’s exposure to credit risk shall calculate its risk-weighted assets in respect of eligible or permitted corporate, sovereign or bank exposures through the application of the relevant formulae and risk components specified in subregulation (11)(d)(ii) above, provided that—

| (A) | when the bank calculates the EAD amount of a particular eligible or permitted exposure, the bank may in the case of undrawn commitments make use of direct estimates of total facility EAD or multiply the relevant committed but undrawn amount by the bank’s own internally estimated credit-conversion factors in respect of the bank’s off-balance-sheet exposures, provided that— |

| (i) | when the credit-conversion factor of the said off-balance-sheet exposure is equal to 100 per cent in terms of the provisions of the foundation IRB approach, the bank shall apply the said credit-conversion factor of 100 per cent; |

| (ii) | the bank shall comply with the relevant requirements relating to the use of own estimates of EAD specified in paragraph (b)(v)(D) above; |

| (iii) | when the bank has securitised only the drawn balances of revolving facilities, the bank shall continue to maintain the relevant required amount of capital and reserve funds against the relevant undrawn balances associated with the said securitised exposures. |

| (B) | the bank shall calculate the relevant required effective maturity of each relevant exposure in accordance with the respective requirements specified below, provided that the Authority may, subject to such conditions as may be specified in writing by the Authority, allow banks that adopted the advanced IRB approach for the measurement of the bank’s exposure to credit risk to apply an effective maturity equal to 2,5 years in respect of specified exposures to small domestic corporate borrowers: |

| (i) | In the case of an exposure with an original maturity of more than or equal to one year, which has determinable cash flows, the effective maturity of the exposure shall be equal to the higher of— |

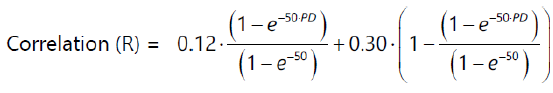

| (bb) | the remaining effective maturity of the exposure, which shall be calculated in years through the application of the formula specified below, subject to a limit of five years. |

That is, the effective maturity (M) of the respective exposures envisaged in this sub-item (i) shall be subject to a floor of one year and a cap of five years, calculated through the application of the formula specified below:

(d)(ii)(b)(i)(bb).png)

where:

| M | is the effective maturity of the relevant exposure |

| CFt | is the relevant cash flows, that is, the relevant principal amount, interest payments and fees, contractually payable by the obligor in period t |

Provided that—

| (i) | the effective maturity of transactions subject to a master netting agreement shall be calculated in accordance with the relevant requirements specified in sub-item (iv) below; |

| (ii) | when the bank is unable to calculate the effective maturity of the respective contractual payments in accordance with the formula and requirements specified hereinbefore, the effective maturity shall be equal to the maximum remaining time, in years, available to the borrower or obligor to fully discharge its respective contractual obligations, that is, the respective amounts related to the principal amount, the related interest and fees, in terms of the relevant loan agreement. |

| (ii) | In the case of transactions or exposures with an original maturity of less than one year, other than exposures in terms of which an obligor obtains ongoing finance from the relevant bank, which first-mentioned transactions or exposures may, for example, arise from fully collateralised or nearly fully collateralised capital market transactions such as OTC derivative transactions or margin lending agreements, or a repo-style transaction such as a repurchase or resale agreement or a securities lending or borrowing transaction, in respect of which the documentation related to the relevant transaction or exposure provides for and requires daily remargining, the effective maturity of the transaction or exposure shall be equal to the higher of— |

| (bb) | the remaining effective maturity of the exposure, calculated in accordance with the formula and relevant requirements specified in sub-item (i)(bb) hereinbefore. |

Provided that—

| (i) | the effective maturity of transactions subject to a master netting agreement shall be calculated in accordance with the relevant requirements specified in sub-item (iv) below; |

| (ii) | the relevant documentation related to the said transaction or exposure shall require daily revaluation; |

| (iii) | the relevant documentation related to the said transaction or exposure shall make provision for the prompt liquidation or set-off of collateral in the event of default or failure to remargin; |

| (iv) | the provisions of this sub-item (ii) shall also apply to any relevant short-term self-liquidating trade transaction, import and export letters of credit or similar transactions, in respect of which the bank shall apply the relevant actual remaining maturity related to the transaction; |

| (v) | the provisions of this sub-item (ii) shall also apply to any issued or confirmed short-term self-liquidating letters of credit with a maturity below one year; |

| (vi) | subject to such conditions as may be specified in writing by the Authority, in addition to the transactions specified hereinbefore in this subitem (ii), the Authority may specify other exposures with an original maturity of less than one year that do not form part of a bank’s ongoing financing of an obligor to be subject to the provision of this sub-item (ii). |

| (iii) | In the case of revolving exposures, the bank shall calculate the relevant required effective maturity based upon the maximum contractual termination date of the relevant facility, and the bank shall not use the repayment date of any current drawing when the bank calculates the relevant required effective maturity related to any revolving exposure; |

| (iv) | In the case of derivative instruments, transactions or exposures subject to a master netting agreement, the bank shall calculate the relevant required effective maturity as the weighted average maturity of the relevant instruments, transactions or exposures within the netting agreement, and the bank shall use the relevant notional amount of each relevant instrument, transaction or exposure within the netting agreement to calculate the relevant required weighted average maturity, provided that in the case of instruments, transactions or exposures falling within the ambit of— |

| (aa) | sub-item (i), the effective maturity of the relevant exposure shall be equal to the higher of— |

| (ii) | the remaining effective maturity of the relevant exposure, subject to a limit of five years; |

| (bb) | sub-item (ii), instead of a minimum effective maturity of one day specified in sub-item (ii), the bank shall apply to the relevant calculated average effective maturity a floor equal to the minimum holding period specified in subregulation (9)(b)(xiv)(A) for the relevant transaction type. Provided that, when more than one transaction type is contained within the relevant master netting agreement, the bank shall apply to the relevant calculated average effective maturity a floor equal to the highest relevant specified holding period related to the respective transaction types included in the relevant master netting agreement; |

| (v) | In the case of any other relevant transaction or exposure not included in sub-items (i) to (iv) hereinbefore, the bank shall assign to the said transaction or exposure an effective maturity of 2,5 years, unless the exposure is subject to further commitment, that is, a repurchase or resale agreement, in which case the bank shall assign to the said exposure an effective maturity of six months, that is, M = 0.5. |

[Regulation 23(13)(d)(ii) substituted by section 2(uuuuuu) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (A) | Subject to the provisions of items (B) and (C) below, a bank shall calculate its risk-weighted exposure in respect of specialised lending in accordance with the relevant requirements relating to corporate exposure specified in subparagraph (ii) above, provided that the bank shall comply with the relevant requirements for the estimation of PD, LGD and EAD specified in subregulation (11)(b)(vi)(A) and in paragraphs (b)(v)(C) and (b)(v)(D) above; |

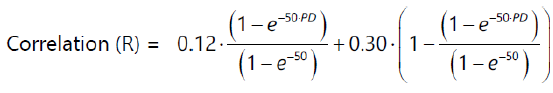

| (B) | In the case of exposures relating to high-volatility commercial real estate, a bank shall apply the asset correlation formula specified below instead of the asset correlation formula that would otherwise apply to corporate exposure. |

[Regulation 23(13)(d)(iii)(B) substituted by section 2(vvvvvv) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (i) | a bank is unable to comply with the prescribed requirements in order to estimate the PD ratio, LGD ratio and EAD amount in terms of the advanced approach for corporate exposure; or |

| (ii) | the Registrar directs a bank to map its internal risk grades to the risk grades specified in subregulation (11)(d)(iii)(C) above, |

the bank shall map its internal risk grades in accordance with the relevant requirements specified in subregulation (11)(d)(iii)(C) above, provided that when the bank is unable to comply with the prescribed requirements in order to estimate the LGD ratio and EAD amount in respect of exposure relating to high-volatility commercial real estate in terms of the advanced approach for corporate exposure, the bank shall use the relevant estimates specified in writing by the Registrar in respect of the LGD ratio and EAD amount relating to corporate exposure.

A bank that adopted the advanced IRB approach for the measurement of the bank's exposure to credit risk shall calculate its risk-weighted assets in respect of retail exposures through the application of the relevant formulae and risk components specified in subregulation (11)(d)(iv) above.

A bank shall calculate its risk-weighted exposure in respect of equity investments in accordance with the relevant requirements of this subregulation (13) read with the relevant requirements specified in subregulations (6) and (8) read with the relevant requirements specified in regulations 31 and 38. Provided that, no investment in a significant minority or majority owned or controlled commercial entity, which investment amounts to less than 15 per cent of the sum of the bank’s issued common equity tier 1 capital and reserve funds, additional tier 1 capital and reserve funds and tier 2 capital and reserve funds, as reported in items 41, 65 and 78 of the form BA 700, shall be assigned a risk weight lower than 100 per cent.

[Regulation 23(13)(d)(v) substituted by section 2(wwwwww) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (vi) | Purchased corporate receivables |

A bank shall calculate its risk-weighted exposure in respect of purchased corporate receivables through the application of the relevant formulae and risk components specified in subregulation (11)(d)(ii) relating to corporate exposure, provided that—

| (A) | the risk weights shall be determined by using the bank's own estimates of PD and LGD as inputs to the corporate risk-weight function; |

| (i) | an exposure other than a revolving facility, the EAD amount shall be equal to the EAD amount determined by the bank, minus the capital requirement relating to the risk of dilution; |

| (ii) | a revolving facility the EAD amount shall be equal to the amount of the purchased receivable plus 40 per cent of any undrawn purchased commitments minus the capital requirement relating to the risk of dilution, that is, in respect of undrawn purchased commitments, the bank shall not use its own estimate of the EAD amount; |

[Regulation 23(13)(d)(vi)(B)(ii) substituted by section 2(xxxxxx) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (C) | when the purchasing bank is able to estimate in a reliable manner the pool's default-weighted average loss rates given default or average PD, the bank may estimate the other risk component based on an estimate of the expected long-run loss rate, that is, the bank may use an appropriate PD estimate to infer the longrun default-weighted average loss rate given default or use a long-run default-weighted average loss rate given default to infer the appropriate PD ratio, provided that— |

| (i) | the LGD ratio used in order to calculate the bank's risk exposure shall in no case be lower than the long-run default-weighted average loss rate given default; |

| (ii) | the bank shall comply with the relevant requirements specified in paragraph (b)(v)(C) above relating to LGD estimates. |

| (D) | the effective maturity in respect of purchased corporate receivables— |

| (i) | shall in the case of drawn amounts, be equal to the pool's exposure-weighted average effective maturity, calculated in accordance with the relevant provisions of paragraph (d)(ii)(B) above; |

| (ii) | shall in the case of undrawn amounts in respect of a committed purchased facility be the same value as for drawn amounts, provided that the facility shall contain effective covenants, early amortisation triggers or other features that protect the bank against a significant deterioration in the quality of the future receivables that the bank is required to purchase over the facility’s term; |

[Regulation 23(13)(d)(vi)(D)(ii) substituted by section 2(yyyyyy) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (iii) | shall in all other cases of undrawn amounts, be equal to the sum of the longest dated potential receivable in terms of the purchase agreement and the remaining maturity of the purchase facility. |

| (E) | the bank may apply the advanced IRB approach for the measurement of the bank’s exposure to credit risk arising from purchased corporate receivables only in relation to exposures to individual corporate obligors eligible for the calculation of the bank’s risk weighted exposure amount in terms of the advanced IRB approach. |

[Regulation 23(13)(d)(vi)(E) inserted by section 2(zzzzzz) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (vii) | Purchased retail receivables |

A bank that adopted the advanced IRB approach for the measurement of the bank's exposure to credit risk shall calculate its risk-weighted assets in respect of purchased retail receivables through the application of the relevant formulae and risk components specified in subregulation (11)(d)(vi) read with the relevant provisions of subregulation (11)(d)(iv) above.

| (viii) | Securitisation or resecuritisation exposures |

A bank shall calculate its risk-weighted assets in respect of a securitisation scheme or resecuritisation exposure in accordance with the relevant requirements specified in subregulations (11)(e) to (11)(p).

(d)(ii)(b)(i)(bb).png)