Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof23. Credit risk: monthly returnDirectives and interpretations for completion of monthly return concerning credit risk (Form BA 200)Subregulation (14) Credit risk mitigation: advanced IRB approachSubregulation (14)(b) Collateral |

| (b) | Collateral |

| (i) | Unless specifically otherwise provided in this subregulation (14), a bank that adopted the advanced IRB approach for the measurement of the bank's exposure to credit risk shall in addition to the minimum requirements specified below, comply with the relevant requirements specified in subregulation (7)(b)(iii) above. |

| (ii) | Risk weighting |

When a bank that adopted the advanced IRB approach for the measurement of the bank’s exposure to credit risk obtains collateral in respect of the bank’s exposure to corporate institutions, sovereigns or banks, the bank may in all relevant cases calculate its own LGD ratios in respect of the said protected exposure, provided that—

[Words preceding Regulation 23(14)(b)(ii)(A) substituted by section 2(bbbbbbb) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (A) | the bank shall comply with the relevant minimum conditions specified in subregulation (13)(b)(v)(C) above, provided that when the bank is unable to comply with the said minimum requirements relating to the use of the bank's own estimates of LGD, the bank shall calculate the relevant exposure's LGD ratios in accordance with the relevant requirements of the foundation IRB approach specified in subregulation (11)(d)(ii) above; |

| (B) | the bank shall measure the LGD ratio as a percentage of the exposure's EAD amount; |

| (C) | when the bank wishes to recognise the effect of a master netting agreement in respect of its repurchase and resale agreements concluded with corporate institutions, sovereigns or banks, the bank shall calculate the relevant required adjusted exposure amount, denoted by E*, in accordance with the relevant requirements specified in subregulation (9)(b)(ix) above, which adjusted exposure amount shall be deemed to represent the exposure’s EAD amount to calculate the bank’s relevant exposure to counterparty credit risk, provided that— |

| (i) | the bank may in relevant cases calculate its own estimate of LGD in respect of the relevant unsecured portion of the bank’s relevant exposure to counterparty credit risk; |

| (ii) | in all relevant cases, in addition to the bank’s exposure to counterparty credit risk, the bank shall also calculate the relevant required amount of capital and reserve funds relating to the bank’s exposure to credit risk or market risk arising from the relevant underlying securities in the master netting agreement; |

[Regulation 23(14)(b)(ii)(C) substituted by section 2(ccccccc) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (D) | irrespective of its credit rating, a resecuritisation instrument shall in no case constitute an eligible instrument for risk mitigation purposes in terms of these Regulations; |

[Regulation 23(14)(b)(ii)(D) substituted by section 2(ddddddd) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (E) | the bank shall in the case of any fully secured corporate exposure, that is, when the value of the collateral after the application of any relevant haircut exceeds the value of the relevant corporate exposure, apply to the relevant secured corporate exposure the LGD floor specified in table 1 below: |

Table 1 |

|

Type of eligible collateral |

LGD floor |

Financial collateral |

0% |

Receivables |

10% |

Commercial or residential real estate |

10% |

Other physical collateral |

15% |

[Regulation 23(14)(b)(ii)(E) inserted by section 2(eeeeeee) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

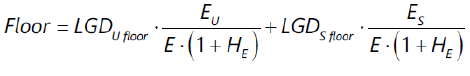

| (F) | the bank shall in the case of any relevant partially secured corporate exposure calculate a weighted average of the unsecured LGD floor for the unsecured portion of the corporate exposure and the secured LGD floor for the secured portion of the corporate exposure, in accordance with the formula specified below: |

where:

LGDU floor and LGDS floor are the relevant floor values for fully unsecured and fully secured corporate exposures respectively, as specified hereinbefore.

[Regulation 23(14)(b)(ii)(F) inserted by section 2(fffffff) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]