Banks Act, 1990 (Act No. 94 of 1990)RegulationsRegulations relating to BanksChapter II : Financial, Risk-based and other related Returns and Instructions, Directives and Interpretations relating to the completion thereof33. Operational risk: six-monthly returnDirectives and interpretations for completion of six-monthly return concerning operational risk (Form BA 400)Subregulations (1) to (4) |

| (1) | The content of the relevant return is confidential and not available for inspection by the public. |

| (2) | The purpose of the return is to, among others— |

| (a) | provide a reconciliation between the bank’s relevant business indicator (BI) components and financial items from its income statement and balance sheet used as input to calculate the bank’s required amount of capital and reserve funds in respect of operational risk; and |

| (b) | calculate a bank’s relevant minimum required amount of capital and reserve funds for operational risk. |

[Regulation 33(2) substituted by section 5(a) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (3) | For the measurement of a bank’s exposure to operational risk and in order to calculate the bank’s relevant required amount of capital and reserve funds for operational risk, the bank shall implement the standardised approach for operational risk and comply with— |

| (a) | the respective requirements specified in subregulation (4) below; and |

| (b) | such further conditions or requirements as may be specified in writing by the Authority. |

[Regulation 33(3) substituted by section 5(b) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (4) | Standardised approach |

| (a) | Unless specifically otherwise provided in this regulation 33 or directed otherwise in writing by the Authority, the relevant requirements specified in this regulation 33 related to the measurement of a bank’s exposure to operational risk and for the calculation of the relevant minimum required amount of capital and reserve funds for operational risk shall, in accordance with the respective requirements specified in regulation 7, apply to all banks and controlling companies on a solo basis and a consolidated basis, provided that— |

| (i) | at the consolidated or sub-consolidated level, the bank or controlling company— |

| (A) | shall appropriately net all the relevant intragroup income and expense items in accordance with the relevant Financial Reporting Standards that may be issued and applied from time to time, to determine, for example, the relevant required fully consolidated or sub-consolidated BI numbers; |

| (B) | shall use the appropriate information in relation to loss experiences, that is, the bank or controlling company, as the case may be, shall not include losses incurred in parts of the group that fall outside the scope of that particular level of consolidation or sub-consolidation; |

| (ii) | when a bank or controlling company is unable to meet the relevant requirements for the calculation of, for example, the Loss Component, the bank or controlling company shall apply such percentage of the Business Indicator Component, which shall not be less than 100 per cent, and such internal loss multiplier, which may be greater than 1, as may be directed in writing by the Authority. |

| (b) | For the measurement of a bank’s exposure to operational risk, the bank shall calculate— |

| (i) | the relevant required business indicator and business indicator component in accordance with the relevant requirements specified in paragraph (f) read with paragraph (g) below; and |

| (ii) | the relevant required internal loss multiplier, which is a scaling factor based upon the bank’s average historical losses and the business indicator component, in accordance with the relevant requirements specified in paragraph (h) below. |

| (c) | General criteria related to loss data identification, collection and treatment |

Since the proper identification, collection and treatment of a bank’s internal loss data are essential prerequisites for the appropriate calculation of the bank’s relevant minimum required amount of capital and reserve funds for operational risk—

| (i) | the bank shall ensure that— |

| (A) | its internally generated loss data used in the calculation of the bank’s minimum required amount of capital and reserve funds for operational risk— |

| (i) | are based on a minimum observation period of no less than ten years, provided that, when the bank adopts or implements the standardised approach for the first time, the bank may in exceptional cases, with the prior written approval of and subject to such conditions as may be specified in writing by the Authority, use an observation period of less than ten years, but not less than five years, when the bank does not have high-quality data for the preceding ten year period; |

| (ii) | are appropriately mapped into the relevant Level 1 loss event types or categories specified in paragraph (d); |

| (B) | its internal loss data are appropriately linked to the bank’s current business lines and business activities, technological processes and risk management policies, processes and procedures; |

| (C) | it has in place duly documented policies, processes and procedures for the identification, collection and treatment of its internal loss data, which policies, processes and procedures shall be subject to— |

| (i) | appropriate and robust validation prior to the use of the bank’s loss data for the calculation of the bank’s minimum required amount of capital and reserve funds for operational risk; |

| (ii) | regular independent review by the bank’s internal and/or external auditors; |

| (D) | it’s internal loss data is comprehensive and captures all material activities and exposures from all the bank’s relevant subsystems and geographic locations; |

| (E) | it duly documents the bank’s criteria for allocating losses to the respective event types specified in table 1 in paragraph (d); |

| (F) | it applies such minimum threshold amount as may be specified in writing by the Authority, in accordance with such requirements or conditions as may be specified in writing by the Authority, for including a loss event in its data collection and calculation of average annual losses; |

| (G) | it collects appropriate information related to, among others— |

| (i) | the relevant gross loss amounts; |

| (ii) | the relevant reference date of an operational risk event, including- |

| (aa) | the date when the event happened or first began, which shall for purposes of these Regulations be referred to as the occurrence date, where relevant and available; |

| (bb) | the date on which the bank became aware of the event, which shall for purposes of these Regulations be referred to as the discovery date; and |

| (cc) | the date or dates when a loss event results in a loss, reserve or provision against a loss being recorded or recognised in the bank’s profit and loss (P&L) accounts, which shall for purposes of these Regulations be referred to as the accounting date; |

| (iii) | any recovery of the gross loss amounts, provided that, for purposes of these Regulations any relevant tax effects, such as, for example, a reduction in the corporate income tax liability due to operational losses, shall not be regarded as a recovery of a loss amount; |

| (iv) | descriptive information about the relevant drivers or causes of the loss event; |

| (H) | the level of detail of any descriptive information collected by the bank is commensurate with and appropriate given the size and nature of the gross loss amount; |

| (I) | operational loss events related to credit risk- |

| (i) | that are accounted for as part of the bank’s risk-weighted exposure for credit risk are not included in the bank’s loss data set for operational risk; |

| (ii) | that are not accounted for as part of the bank’s risk-weighted exposure for credit risk are included in the bank’s loss data set for operational risk; |

| (J) | operational risk losses related to market risk are treated as operational risk for purposes of calculating the bank’s minimum required amount of capital and reserve funds for operational risk; |

| (K) | it has in place appropriately robust processes to independently review the comprehensiveness and accuracy of the bank’s loss event data; |

| (ii) | the Authority may request or require the bank not only to map its historical internal loss data into the relevant Level 1 categories specified in table 1 in paragraph (d), but to also provide the relevant data to the Authority. |

| (d) | Loss event types |

Table 1 |

|||

Category relating to event type (Level 1) |

Definition |

Category relating to activity (Level 2) |

Examples of activities include: (Level 3) |

Internal fraud |

Losses due to acts of a type intended to defraud, misappropriate property or circumvent regulations, the law or company policy, excluding diversity/discrimination events, which acts involve at least one internal party |

Unauthorised activity |

Transactions intentionally not reported Unauthorised transaction with monetary loss Intentional misrepresentation of position |

Theft and fraud |

Fraud/credit fraud/worthless deposits Theft/extortion/embezzlement/ robbery Misappropriation of assets Malicious destruction of assets Forgery Cheque kiting Smuggling Account take-over/impersonation/etc. Tax non-compliance/wilful evasion Bribes/kickbacks Insider trading (not on bank/ firm’s account) |

||

External fraud |

Losses due to acts of a type intended to defraud, misappropriate property or circumvent the law, by a third party |

Theft and fraud |

Theft/ robbery Forgery Cheque kiting |

Systems security |

Hacking damage Theft of information with monetary loss |

||

Employment practices and workplace safety |

Losses arising from acts inconsistent with employment, health or safety laws or agreements, from payment of personal injury claims, or from diversity / discrimination events |

Employee relations |

Compensation, benefit, termination issues Organised labour activity |

Safe environment |

General liability such as slip and fall Employee health & safety rules events Workers compensation |

||

Diversity and discrimination |

All discrimination types |

||

Clients, products and business practices |

Losses arising from an unintentional or negligent failure to meet a professional obligation to specific clients (including fiduciary and suitability requirements), or from the nature or design of a product. |

Suitability, disclosure and fiduciary |

Fiduciary breaches / guideline violations Suitability / disclosure issues (KYC, etc.) Retail customer disclosure violations Breach of privacy Aggressive sales Account churning Abuse of confidential information Lender liability |

Improper business or market practices |

Antitrust Improper trade / market practices Market manipulation Insider trading (on bank/ firm’s account) Unlicensed activity Money laundering |

||

Product flaws |

Product defects (unauthorised, etc.) Model errors |

||

Selection, sponsorship and exposure |

Failure to investigate client per guidelines Exceeding client exposure limits |

||

Advisory activities |

Disputes over performance of advisory activities |

||

Damage to physical assets |

Losses arising from loss or damage to physical assets from natural disaster or other events. |

Disasters and other events |

Natural disaster losses Human losses from external sources (terrorism, vandalism) |

Business disruption and system failures |

Losses arising from disruption of business or system failures |

Systems |

Hardware Software Telecommunications Utility outage / disruptions |

Execution, delivery and process management |

Losses from failed transaction processing or process management, from relations with trade counterparties and vendors |

Transaction capture, execution and maintenance |

Miscommunication Data entry, maintenance or loading error Missed deadline or responsibility Model / system failure Accounting error / entity attribution error Other task malfunctioning Delivery failure Collateral management failure Reference data maintenance |

Monitoring and reporting |

Failed mandatory reporting obligation Inaccurate external report (loss incurred) |

||

Customer intake and documentation |

Client permissions / disclaimers missing Legal documents missing / incomplete |

||

Customer/client account management |

Unapproved access given to accounts Incorrect client records (loss incurred) Negligent loss or damage of client assets |

||

Trade counterparties |

Non-client counterparty misperformance Misc. non-client counterparty disputes |

||

Vendors and suppliers |

Outsourcing Vendor disputes |

||

| (e) | Additional requirements specifically related to loss data identification, collection and treatment |

In order to ensure that the bank develops and maintains a robust operational risk loss data set based upon, among others, the bank’s available internal data, the bank shall have in place and maintain robust policies, processes and procedures that address multiple features, such as, for example, an appropriate gross loss definition, matters related to reference dates as envisaged in paragraph (c) hereinbefore, and grouped losses, provided that—

| (i) | in this regard, for purposes of this regulation 33, unless specifically otherwise stated— |

| (A) | gross loss means a loss before the bank takes into account any form of recovery; |

| (B) | net loss means a loss after the bank takes into account the impact of any form of recovery; |

| (C) | recovery means an independent occurrence, related to the bank’s original loss event, separate in time, in which funds or inflows of economic benefits are received by the bank from a third party, such as, for example, a payment received from an insurer, a repayment received from a perpetrator of fraud, or a recovery of a misdirected transfer; |

| (ii) | the bank shall ensure that— |

| (A) | it is at all times able to appropriately identify, among others, the relevant gross loss amounts, non-insurance recoveries, and insurance recoveries for all the bank’s relevant operational loss events; |

| (B) | it includes the respective items specified below in the bank’s relevant gross loss amount in the bank’s loss data set: |

| (i) | direct charges, including impairments and settlements, to the bank’s profit-and-loss account, as well as write-downs due to the operational risk event; |

| (ii) | costs incurred as a consequence of the event, including external expenses with a direct link to the operational risk event, such as, for example, legal expenses directly related to the event and fees paid to advisors, attorneys or suppliers, and costs of repair or replacement, incurred to restore the position that was prevailing before the operational risk event; |

| (iii) | provisions or reserves accounted for in the bank’s profit-and-loss account against the potential operational loss impact; |

| (iv) | losses stemming from operational risk events with a definitive financial impact, which may be temporarily booked in transitory and/or suspense accounts and are not yet reflected in the bank’s profit-and-loss account, which may be referred to in the bank’s records as “pending losses”, provided that the bank shall include in its loss data set all relevant material pending losses within a time period commensurate with the size and age of the relevant pending item; |

| (v) | negative economic impacts accounted for in a particular financial accounting period, due to operational risk events, for example, impacting the cash flows or financial statements of previous financial accounting periods, which is often being referred to as timing losses, which timing impacts— |

| (aa) | typically relate to the occurrence of operational risk events that may result in the temporary distortion of the bank’s financial accounts, such as, for example, revenue overstatement, accounting errors or mark-to-market errors; |

| (bb) | may not necessarily represent a true financial impact on the bank, since the net impact over time may be equal to zero, they may represent a material misrepresentation of the bank’s financial statements if the error continues across more than one financial accounting period, |

Provided that the bank shall appropriately include all relevant material timing losses in the bank’s loss data set when they are due to operational risk events that span more than one financial accounting period and comply with such further requirements as may be directed in writing by the Authority;

| (C) | it excludes the respective items specified below from the bank’s relevant gross loss amount in the bank’s loss data set: |

| (i) | costs related to general maintenance contracts on property, plant or equipment; |

| (ii) | internal or external expenditures to enhance the business after the operational risk losses, such as, for example, upgrades, improvements, risk assessment initiatives or enhancements; and |

| (iii) | insurance premiums. |

| (D) | it uses the relevant accounting date for building its loss data set, that is— |

| (i) | the bank shall in the case of legal loss events use a date no later than the date of accounting for including the relevant losses in its loss data set; |

| (ii) | in the case of legal loss events, the date of accounting shall be the date when a legal reserve is established for the probable estimated loss in the bank’s profit-and-loss account; |

| (E) | losses caused by a common operational risk event or by related operational risk events over time, but posted to the bank’s relevant accounting records over several years, shall be allocated to the relevant corresponding years of the loss database, in line with their accounting treatment; |

| (F) | it is at all times able to appropriately use losses net of recoveries, including, for example, insurance recoveries, in the bank’s loss data set; |

| (G) | recoveries are used to reduce losses only after the bank has received any relevant payment and, as such, any receivable amount is not reflected or accounted as a recovery; |

| (H) | on prior written request, the bank is able to provide the Authority with all relevant information related to verification of payments received to net losses; |

| (f) | Matters related to a bank’s business indicator |

For purposes of this regulation 33, and in particular paragraph (g) below, a bank shall determine the relevant required variables of its Business Indicator in accordance with, among others, the respective requirements specified in table 1 below, provided that the P&L items specified in subparagraphs (i) to (xi) below shall not form part of any relevant BI variable or item:

| (i) | Income and expense items from insurance or reinsurance businesses. |

| (ii) | Premiums paid and reimbursements/payments received from insurance or reinsurance policies purchased. |

| (iii) | Administrative expenses, including staff expenses, outsourcing fees paid for the supply of non-financial services, such as, for example, logistical, IT and human resources, and other administrative expenses, such as, for example, IT, utilities, telephone, travel, office supplies and postage. |

| (iv) | Recovery of administrative expenses, including recovery of payments on behalf of customers, such as, for example, taxes debited to customers. |

| (v) | Expenses of premises and fixed assets, except when these expenses result from operational loss events. |

| (vi) | Depreciation/amortisation of tangible and intangible assets, except depreciation related to operating lease assets, which shall be included in financial and operating lease expenses. |

| (vii) | Provisions/reversal of provisions, such as, for example, in relation to pensions, commitments and guarantees given, except for provisions related to operational loss events. |

| (viii) | Expenses due to share capital repayable on demand. |

| (ix) | Impairment/reversal of impairment, such as, for example, in relation to financial assets, non-financial assets, investments in subsidiaries, joint ventures and associates. |

| (x) | Changes in goodwill recognised in profit or loss. |

| (xi) | Corporate income tax, that is, tax based on profits, including current tax as well as deferred tax. |

Table 1 |

||||||||||||

BI variable or component |

P&L or balance sheet item |

Description |

Typical sub-items |

|||||||||

Interest, lease and dividend |

Interest income |

Interest income from all relevant financial assets and other interest income, including interest income from financial and operating leases and profits from leased assets |

|

|||||||||

Interest expenses |

Interest expenses from all financial liabilities and other interest expenses, including interest expense from financial and operating leases, losses, depreciation and impairment of operating leased assets |

|

||||||||||

Interest earning assets (balance sheet item) |

Total gross outstanding loans, advances, interest bearing securities, including government bonds, and lease assets measured at the end of each relevant financial year |

|||||||||||

Dividend income |

Dividend income from investments in stocks and funds not consolidated in the bank’s financial statements, including dividend income from non-consolidated subsidiaries, associates and joint ventures. |

|||||||||||

Services |

Fee and commission income |

Income received from providing advice and services, including income received by the bank as an outsourcer of financial services. |

Fee and commission income from:

|

|||||||||

Fee and commission expenses |

Expenses paid for receiving advice and services, including outsourcing fees paid by the bank for the supply of financial services, but not outsourcing fees paid for the supply of non-financial services, such as, for example logistical, IT or human resources. |

Fee and commission expenses from:

|

||||||||||

Other operating income |

Income from ordinary banking operations not included in other BI items but of similar nature, excluding any income from operating leases |

|

||||||||||

Other operating expenses |

Expenses and losses from ordinary banking operations not included in other BI items but of similar nature and from operational loss events, excluding any expenses from operating leases |

|

||||||||||

Financial |

Net profit (loss) on the trading book |

|

||||||||||

Net profit (loss) on the banking book |

|

|||||||||||

| (g) | Business Indicator and Business Indicator Component |

Based upon, among others, the respective criteria, components and requirements specified in paragraph (f) read with the relevant requirements specified in this paragraph (g), a bank—

| (i) | shall firstly calculate the relevant required Business Indicator (BI) through the application of the formulae specified below: |

BI = ILDC + SC + FC

where:

a solid bar above any relevant term or component in the formulae specified below indicates that that relevant term or component of the formula shall be calculated as the average amount during a period of three years, that is, the average of t, t-1 and t-2, provided that the bank shall firstly calculate the absolute value of all relevant net items, such as, for example, interest income – interest expense, on a year-by-year basis, and only after the bank has calculated the relevant year-by-year net amounts, the bank shall calculate the relevant required average amount during the relevant three-year period

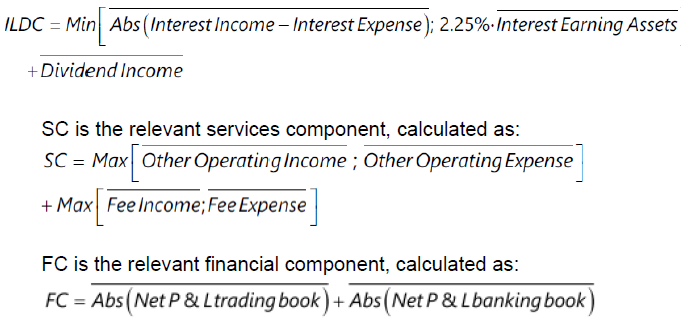

ILDC is the relevant interest, leases and dividend component, calculated as:

Provided that—

| (A) | the bank’s measurement of BI shall appropriately include all relevant BI items and losses that result from acquisitions of relevant businesses and mergers; |

| (B) | when the bank wishes to exclude divested activities from the calculation of the bank’s BI, the bank shall submit in writing sufficiently strong detailed justification to demonstrate to the satisfaction of the Authority that there is no similar or residual exposure and that the excluded activity or experience has no relevance to other continuing activities or products of the bank, provided that should the Authority grant the requested approval, the bank shall disclose to the public the relevant exclusions, with appropriate narratives, and such additional information as may be specified in this subregulation (4) or specified in writing by the Authority. |

| (ii) | shall thereafter multiply the relevant Business Indicator, that is, BI, with the marginal coefficients αi, which marginal coefficients increase with the size of the BI, as specified in Table 1 below, in order to calculate the relevant required Business Indicator Component (BIC). |

Table 1 |

||

BI ranges and marginal coefficients |

||

Bucket |

BI range (R billion) |

BI marginal coefficients (αi) |

1 |

Such amount or range and subject to such conditions as may be directed in writing by the Authority |

12% |

2 |

Such amount or range and subject to such conditions as may be directed in writing by the Authority |

15% |

3 |

Such amount or range and subject to such conditions as may be directed in writing by the Authority |

18% |

| (iii) | with a BI greater than or equal to such amount or range and subject to such conditions as may be directed in writing by the Authority— |

| (A) | shall ensure that the bank’s data collection related to its operational loss exposure and experience is sound and that the quality and integrity of the bank’s operational loss data provide a sound base for the calculation of the bank’s required amount of capital and reserve funds for its exposure to operational risk; |

| (B) | shall use its relevant loss data as a direct input into the calculation of the bank’s relevant required amount of capital and reserve funds for operational risk, |

Provided that a bank that is unable to demonstrate to the satisfaction of the Authority that the quality and integrity of the bank’s data provide a sound base for the calculation of the bank’s required amount of capital and reserve funds for operational risk—

| (i) | shall maintain capital and reserve funds for operational risk of at least equal to 100 per cent of the bank’s BIC and the Authority may direct the bank in writing to apply an ILM greater than 1; and |

| (ii) | shall disclose to the public the relevant information related to the bank’s BIC and ILM for operational risk. |

| (h) | Internal Loss Multiplier |

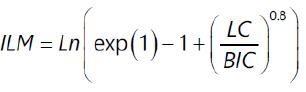

A bank shall calculate the relevant required Internal Loss Multiplier, that is, ILM, which is influenced by the bank’s internal operational risk loss experience, and which in turn influences the bank’s relevant required amount of capital and reserve funds, through the application of the formula specified below:

where:

| LC | is the Loss Component, equal to 15 times the bank’s average annual operational risk losses incurred during the preceding 10 years, provided that, subject to the prior written approval of and such conditions as may be specified in writing by the Authority— |

| (i) | a bank that does not have 10 years of high-quality loss data may use a minimum of five years of data to calculate the bank’s relevant required Loss Component; |

| (ii) | a bank that does not have five years of high-quality loss data may, in exceptional cases, be allowed by the Authority to calculate its capital requirement based solely on the bank’s BI Component; |

| (iii) | the Authority may allow a bank to calculate its capital requirement using fewer than five years of loss data when the bank’s ILM is greater than 1 and the Authority is of the opinion the bank’s losses are sufficiently representative of the bank’s exposure to operational risk; |

| (iv) | when the bank wishes to exclude certain operational loss events from the Loss Component, because the bank is of the opinion that the relevant loss events are no longer relevant to the bank's risk profile, which may be due to, for example, settled legal exposures or divested businesses, the bank shall submit in writing sufficiently strong detailed justification to demonstrate to the satisfaction of the Authority that there is no similar or residual exposure and that the excluded loss experience has no relevance to other continuing activities or products of the bank, provided that— |

| (A) | the relevant loss event to be considered for exclusion shall be equal to or greater than such threshold amount or percentage of the bank’s average losses during a specified period as may be directed in writing by the Authority; |

| (B) | a loss event shall only be considered by the Authority for exclusion from the bank’s Loss Component after the loss event, other than losses related to divested activities or businesses, has been included in the bank’s operational risk loss database for such a minimum period as may be directed in writing by the Authority; |

| (C) | should the Authority grant the requested approval, the bank shall disclose to the public the relevant total loss amount as well as the relevant number of exclusions, with appropriate narratives; |

| ILM | is equal to one when the bank’s loss and business indicator |

components are equal, provided that-

| (i) | when the bank’s LC is greater than the BIC, the ILM will be greater than one. That is, a bank with losses that are high relative to its BIC shall be required to hold a higher amount of capital and reserve funds, due to the incorporation of internal losses into the calculation methodology applied in terms of this subregulation (4); |

| (ii) | when the bank’s LC is lower than the BIC, the ILM will be lower than one. That is, a bank with losses that are low relative to its BIC will be allowed to hold a lower amount of capital and reserve funds, due to the incorporation of internal losses into the calculation methodology applied in terms of this subregulation (4); |

| (iii) | subject to such conditions as may be specified in writing by the Authority, the Authority may, in its sole discretion, decide to set the value of ILM equal to 1 for all banks or for such a subgroup of banks as may be directed in writing by the Authority. |

| (i) | Required amount of capital and reserve funds for operational risk |

A bank shall calculate its relevant required amount of capital and reserve funds for operational risk as the product of the bank’s relevant Business Indicator Component, that is, BIC and Internal Loss Multiplier, that is, ILM, calculated in accordance with, among others, the requirements respectively specified in paragraphs (f) and (g) hereinbefore, that is,

MRCOR = BIC * ILM

Provided that—

| (i) | normally the minimum required amount of capital and reserve funds of a bank that falls into bucket 1 will not be influenced by the bank’s internal loss data, that is, since the bank’s ILM is equal to 1, the bank’s relevant required amount of capital and reserve funds for operational risk will be equal to the bank’s BIC, that is, =12% * BI, provided that subject to such conditions as may be specified in writing by the Authority, the Authority may allow or require a bank that falls into bucket 1 to include internal loss data into the calculation of the bank’s relevant required amount of capital and reserve funds for operational risk; |

| (ii) | subject to such conditions as may be specified in writing by the Authority, the Authority may decide to set the value of ILM equal to 1 for all banks or for such a subgroup of banks as may be directed in writing by the Authority. |

| (j) | Matters related to disclosure |

When—

| (i) | a bank’s BI, calculated in accordance with the relevant requirements specified in paragraph (g) hereinbefore, is equal to or greater than such amount or range as may be directed in writing by the Authority; or |

| (ii) | the bank uses internal loss data in the calculation of the bank’s relevant required amount of capital and reserve funds for operational risk, |

the bank shall disclose to the public—

| (A) | the bank’s annual loss data for each of the relevant ten years or, with the prior written approval of the Authority granted in terms of the provisions of paragraph (h) hereinbefore, less than ten years, included in the bank’s calculation of ILM, even when the bank conducts business in a jurisdiction that has elected to apply an ILM equal to one; |

| (B) | the bank’s loss data— |

| (i) | on a gross basis; and |

| (ii) | after recoveries and loss exclusions have been taken into consideration; |

| (C) | each of the bank’s relevant BI sub-component envisaged in paragraph (g) hereinbefore, for each of the relevant three years of the BI component calculation, |

Provided that when the bank excludes internal loss data from the relevant required calculations specified in this subregulation (4), due to the bank’s non-compliance with the specified requirements related to loss data, the bank shall disclose to the public such information, including the application of any resulting multipliers, as may be directed in writing by the Authority.

[Regulation 33(4) substituted by section 5(c) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025]

| (5) | [Regulation 33(5) deleted by section 5(d) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025] |

| (6) | [Regulation 33(6) deleted by section 5(e) of Notice 6342, GG52907, dated 26 June 2025, shall come into operation on 1 July 2025] |